Navigating the Final Stretch of the "Fourth Turning"

As we close the book on 2025, we find ourselves at a remarkable juncture.

The S&P 500 has spent months testing a breakout against a 100-year-old trendline, a structural ceiling that has capped the market since the legendary peaks of 1929 and 2000.

While the consensus remains firmly in the “Goldilocks” camp, betting on moderate growth and gently easing inflation, our charts suggest we are entering a danger zone where cycles, policy, and plumbing are all colliding at once.

And this isn’t just about high prices, it is about the fragility of the “Upper Branch” of our K-shaped economy.

We are witnessing a regime where resilience is being bought with record-breaking deficit spending, levels unseen outside of world wars.

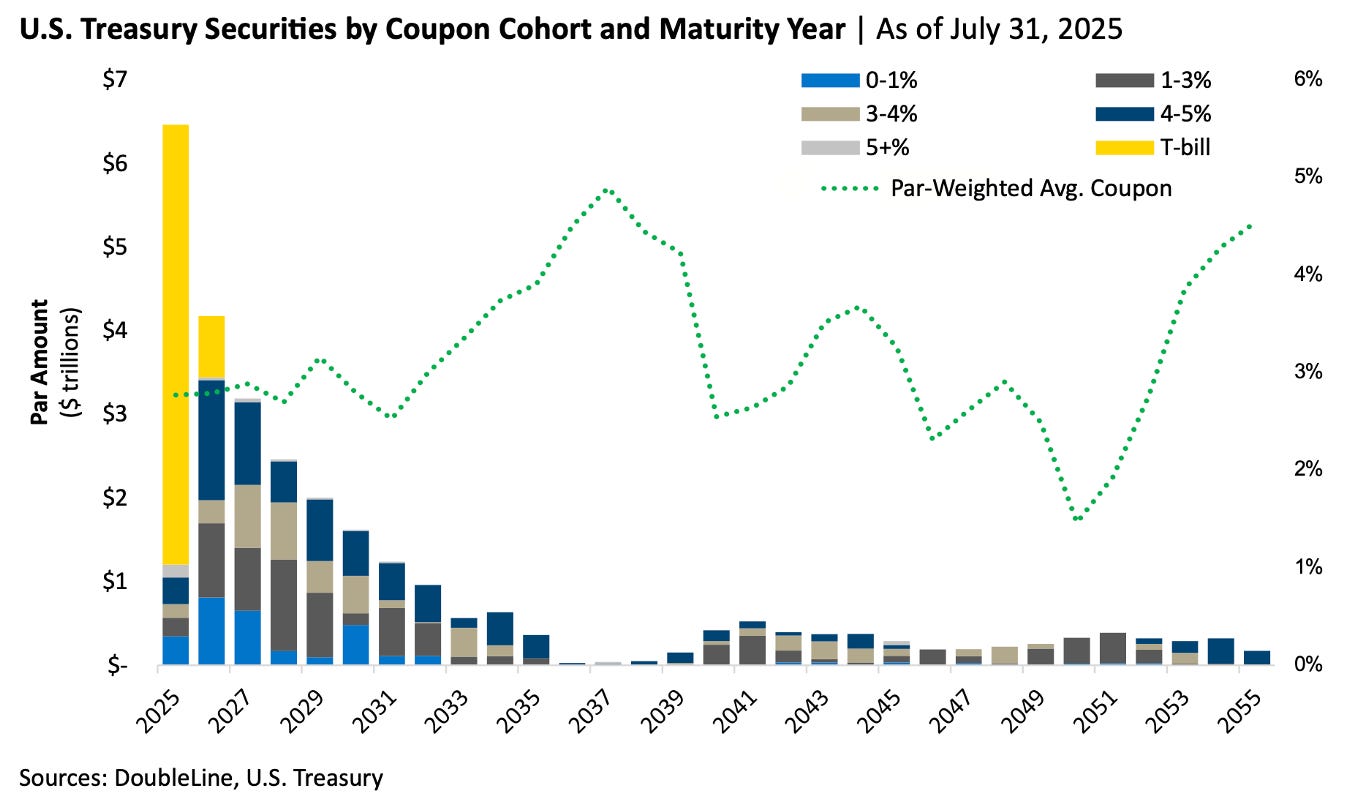

As 2026 begins, the system faces a massive $9 trillion maturity wall that must be rolled over regardless of market conditions. We believe the Federal Reserve’s recent pivot to “Reserve Management Purchases” is a forced admission that years of balance sheet expansion to support debt is now the only way forward.

So here is where we stand as 2026 begins, and how we are positioning for the endgame.

The Fed "Turns Japanese"

The most consequential development of late 2025 wasn’t a headline earnings print; it was the Federal Reserve quietly flipping the switch on liquidity.

After three years of draining cash through Quantitative Tightening (QT), the Fed has pivoted to Reserve Management Purchases (RMPs).

Officially, these are “technical operations” to keep the banking system flush. In reality, the Fed is back to expanding its balance sheet to support a system that can no longer carry its own weight.

This is exactly the Japan roadmap we’ve been describing: a regime where central banks are forced to suppress yields and inject liquidity just to keep the great debt-rollover machine running.

The $9 Trillion Sword of Damocles

Why the urgency?

Because the U.S. government is facing a gargantuan maturity wall.

In 2026 alone, more than $9 trillion in U.S. debt must be rolled over.

This isn’t optional; it’s calendar-driven demand for cash.

The pressure to lower interest rates isn’t just about “growth”, it’s about survival.

Cheaper borrowing costs today mean a less painful interest bill for a government that is already running war-like deficits during peacetime.

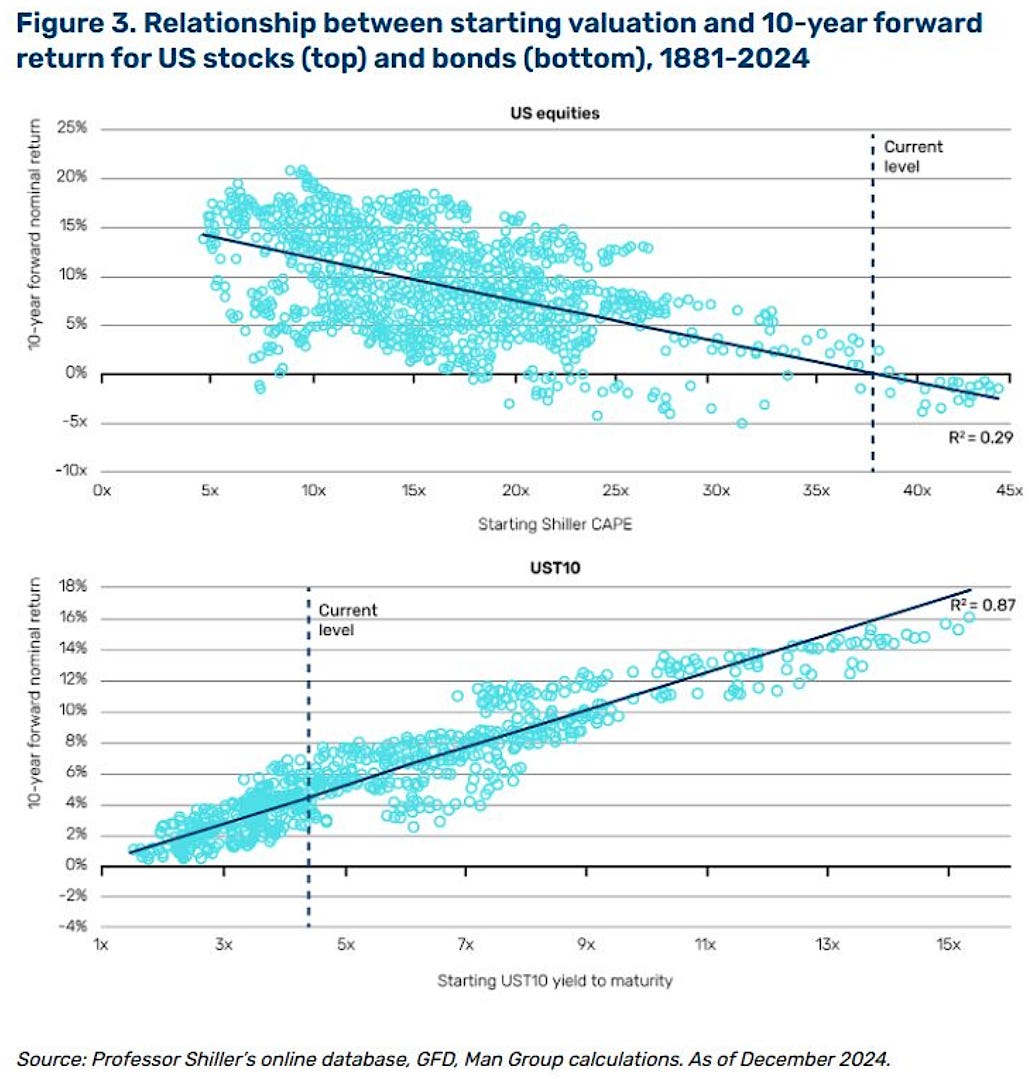

Valuations: The Shiller Warning

We must be honest about where we are.

By almost any measure, the market has never been more expensive.

The Shiller CAPE ratio1 currently sits near 40, a level only surpassed during the peak of the dot-com bubble.

Historically, when valuations reach these heights, expected 10-year forward real returns for U.S. equities are close to zero..

While the “Upper Branch” of the economy is still celebrating AI euphoria, we believe the spring is being coiled for a major reversion.

Our Strategic Playbook for 2026

In this environment, we don’t hit reset.

We maintain continuity.

Here is how the VMF's Strategic Asset Allocation Model Portfolio is leaning (subscribers only)

The Healthcare Anchor: We’ve added tactical positions in high-quality, cash-generative businesses that can lead even if the broader AI trade pauses.

The Precious Metals Barbell: Our overweight gold and silver remains a core pillar. They aren’t just “inflation hedges”; they are optionality on a monetary system that is being forced into permanent debasement.

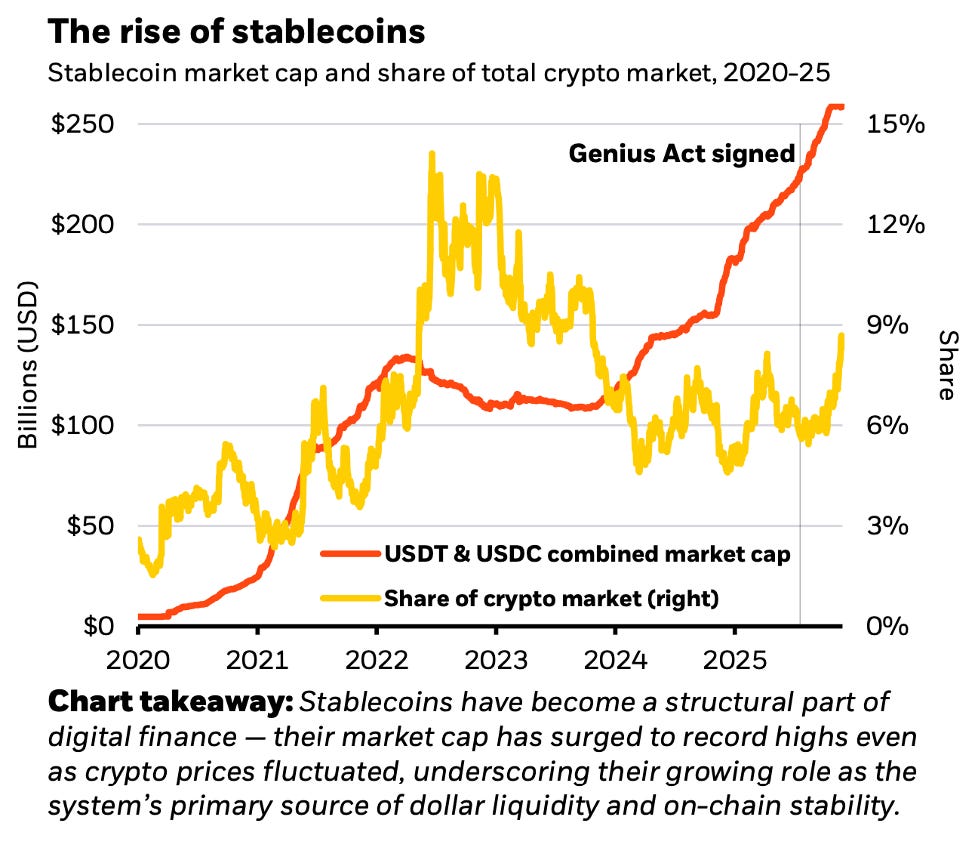

Crypto: The Next Liquidity Wave: While Ethereum and Solana are, in our view, caught in ‘bear traps,’ we believe they stand to benefit most from the next liquidity push.

As regulated stablecoin rails industrialize through new federal standards, the networks with the most activity will gain the most leverage.

Small-Cap “Ick” Investing: In line with our work in the deep value universe, we are building an allocation to small caps, where expectations are ‘buried in the floor.’

This is where price eventually meets value, often resulting in hard re-ratings.

The Climax of the Storm

Strauss and Howe’s framework suggests that Fourth Turnings end when a society finally rebuilds its civic order after a major reset.

Whether that climax arrives in 2026 or 2028, the “air pocket” risk is rising daily.

We are keeping our party shoes on, but we are standing right next to the exit door.

Our job in 2026 is to keep you on the right side of the big rotations while the generational clock strikes midnight.

Are you ready for 2026? To see our full, position-by-position trading plans and the technical triggers we’re watching for the next rotation, subscribe to VMF Research today.

The CAPE ratio (Cyclically Adjusted Price-to-Earnings), popularized by Robert Shiller, is a valuation metric that takes a stock index’s current price and divides it by the average inflation-adjusted earnings over the last 10 years. By smoothing earnings across a full cycle, it filters out temporary booms and busts and gives a cleaner sense of how expensive or cheap the market is versus its own history.

High CAPE = rich valuations and lower expected long-term real returns.

Low CAPE = cheaper market and higher expected long-term real returns.