The Q-Day Manifesto

The 2026 Quantum Shock, Retail Fear, and the Upgrade Cycle Nobody Can Avoid

The most dangerous risks aren’t the ones everyone is talking about.

Sometimes they’re the ones that sound like science fiction… right up until they don’t.

While the consensus stays glued to the next Trumpquake or 25-basis-point Fed move, a much larger (and stranger) shadow hangs over 2026.

It’s called Q-Day.

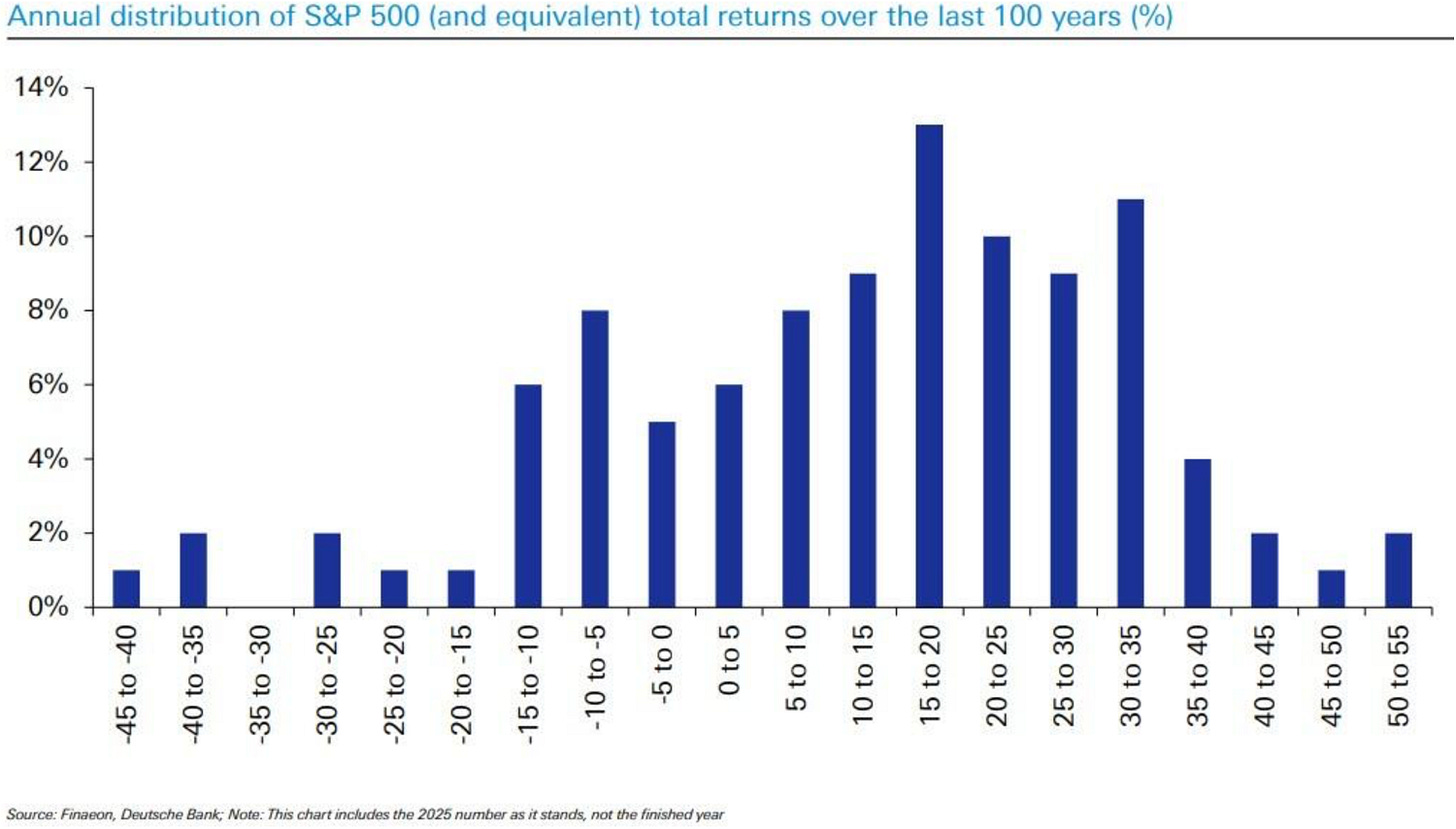

You see, in macro, we care about fat tails.

Not because they’re likely… but because they’re asymmetric.

Small probability. Massive impact.

And when the impact is big enough, the market doesn’t need certainty.

It only needs doubt.

The Myth of the “Unbreakable” Lock

Whether you hold Bitcoin, trade on a banking app, or run a corporate payroll, your financial life rests on one quiet assumption:

The locks still work.

Today’s system runs on cryptographic standards that would take classical machines an absurd amount of time to crack.

Quantum computing changes the math.

Using qubits, these systems can (in theory) solve the kinds of problems that protect private keys and secure digital identity.

And here’s the part most investors miss:

Quantum risk doesn’t have to be “true” today to matter in markets.

It only has to be believable enough to spread.

This is exactly the kind of narrative that becomes a perfect fear catalyst, especially among retail participants. It sounds technical. It sounds existential. It comes wrapped in real science. And it’s easy to extrapolate into two words:

“Crypto is finished.”

That’s why it travels fast.

But here’s the nuance: apocalyptic stories are usually not the real driver of marginal flows… they’re often the story layer pasted on top of real market plumbing.

When markets are fragile, narratives don’t just explain price action.

They amplify it.

And that’s what makes Q-Day dangerous... not as an immediate certainty, but as a reflexive uncertainty engine.

Q-Day as a Fear Catalyst, Not a Crypto Killshot

Let’s be clear about our stance:

Yes, a credible quantum breakthrough would be a Digital Trust Event.

High impact. Regime-level implications.

But no, we are not treating this as “the end of crypto.”

In fact, we remain constructive on the crypto complex into 2026.

Why?

Because the biggest macro forces that matter for crypto are not science-fiction headlines.

They’re the real-world drivers of liquidity, incentives, and institutional adoption.

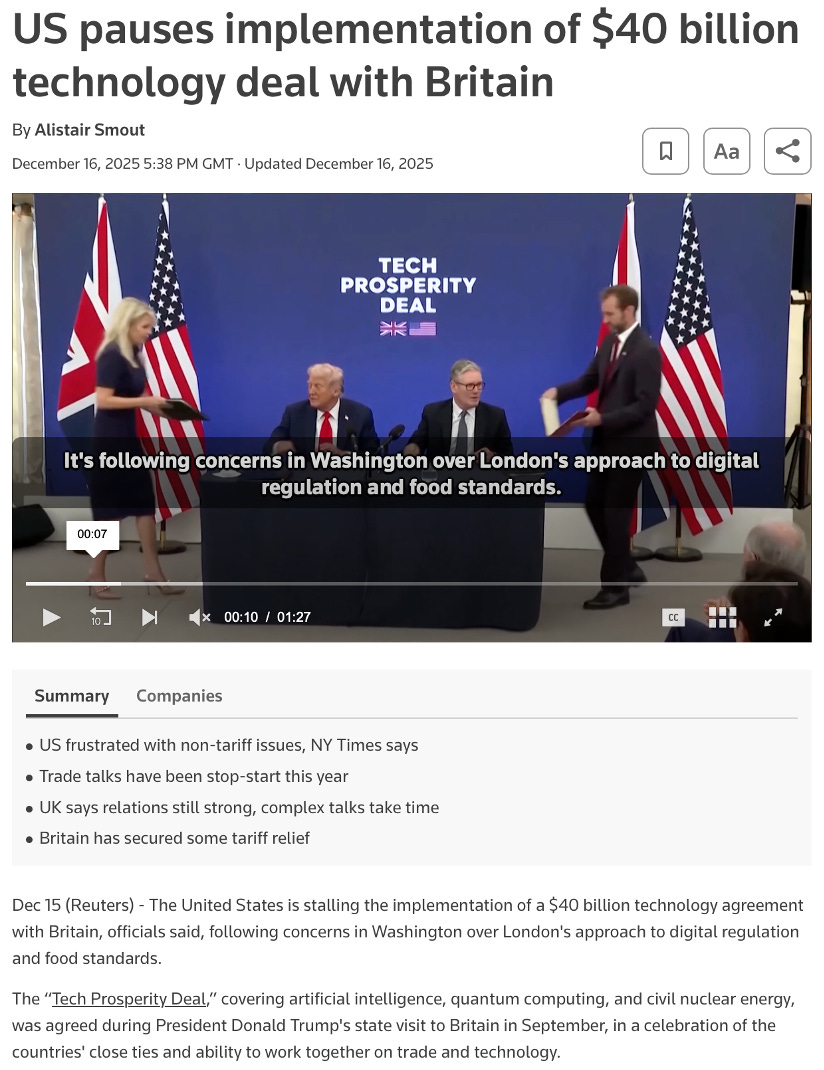

Crypto spent too much of 2025 disappointing investors on price action… even as the foundations kept getting stronger: regulatory rails, tokenization, institutional validation, and the steady migration of blockchain from novelty to plumbing.

So when you see “quantum doom” trending, our base case is not panic liquidation.

Our base case is this:

Q-Day headlines are more likely to function as a volatility trigger, an uncertainty shock that rattles confidence, than as a fundamental death sentence.

And in markets, volatility creates something precious:

Mispricing.

The Great Infrastructure Upgrade Cycle

Here’s the real investing takeaway.

If Q-Day is the left tail (the crash narrative), the right tail is the opportunity:

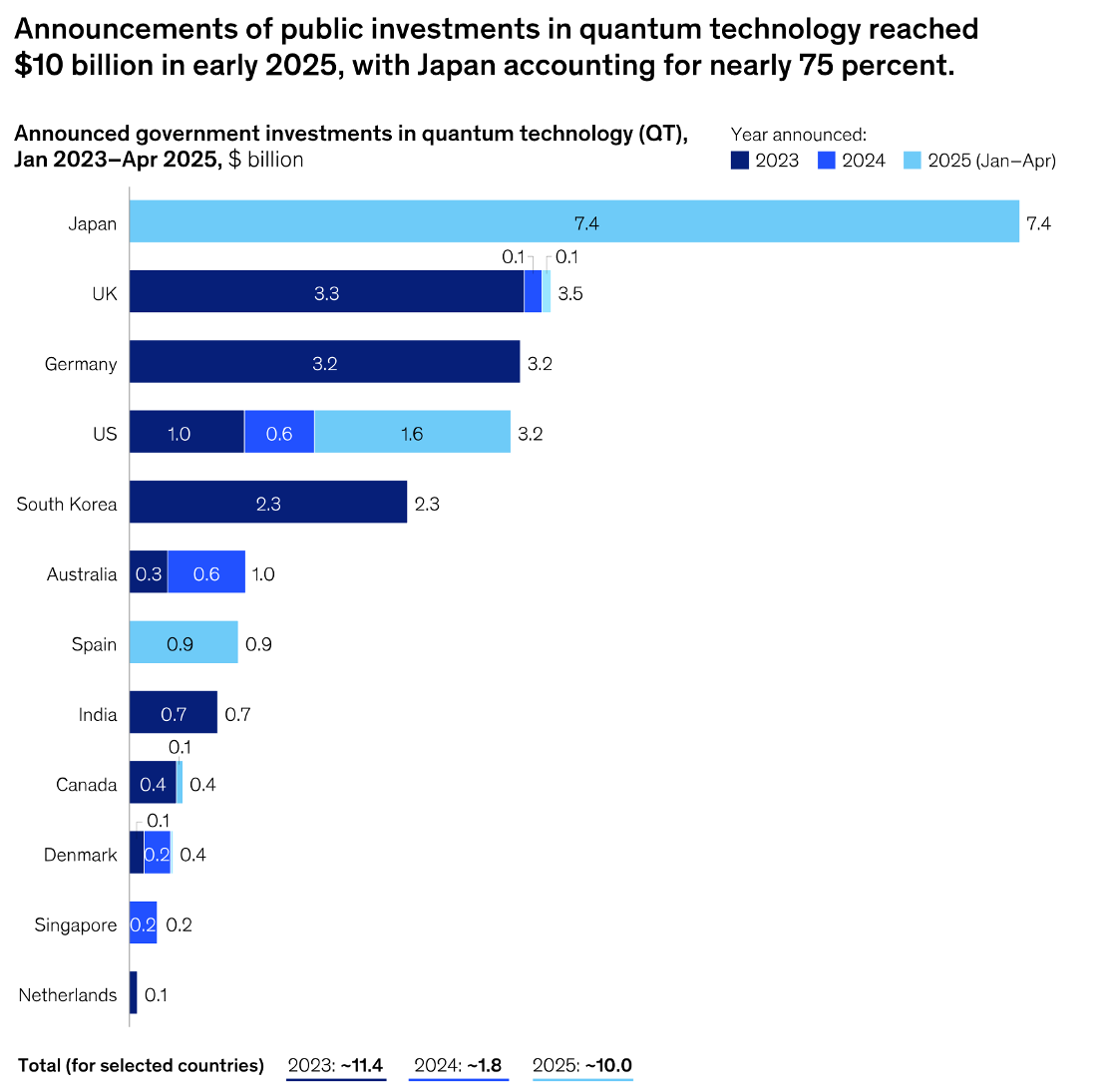

A massive, mandatory global upgrade cycle.

If encryption standards are ever in doubt - seriously in doubt - then every bank, payment processor, government agency, and enterprise security stack becomes a buyer of Post-Quantum Cryptography (PQC).

That’s not optional spending.

That’s survival spending.

And this is where the opportunity set becomes obvious:

Cybersecurity & Identity Management: migrating away from legacy assumptions toward quantum-resistant standards.

Hardened Systems: securing networks against “harvest now, decrypt later” strategies.

Crypto-Agility: protocols and platforms adapting their signature schemes and security layers to remain future-proof.

In other words: even if crypto survives the narrative shock (we believe it will), the broader system still pays the bill.

Resilience Through “Parallel” Stores of Value

In a fat-tail world, the ultimate form of risk management is convexity… the ability to survive a regime shift and profit from the chaos.

If digital trust ever breaks, the rational move is to hold stores of value that don’t depend on digital assumptions at all.

This is why our Model Portfolio doesn’t choose between “Crypto” and “Gold.” We own both. Crypto is upside convexity. Gold and Silver are “no-password” assets, a physical hedge against a digital trust event.

“When tails are fat, convexity stops being a ‘nice-to-have.’ It becomes the difference between surviving a regime shift and being steamrolled by it.”

Don’t Get Blindsided by the Future

The future doesn’t arrive politely; it kicks the door in.

Most investors will spend 2026 reacting to the headlines. At VMF Research, we spend our time modeling the “Outrageous” scenarios before they hit the tape.

We are currently finalizing a deep-dive on a specific cybersecurity compounder that we believe is the best-in-class play for the coming PQC migration. In a world of fat tails, being early is the only way to be protected. Stay tuned.

To access our full 2026 Model Portfolio, including our allocations to the Quantum-Security upgrade cycle and our Options Overlay strategy, join our inner circle today.

This framework around Q-Day as a reflexive uncertainty engine rather than an existential threat is spot on. The distinction between the fear narrative and the actual infrastructure opportunity is what most people will completly miss. I've been thinking about convexity in my own portfolio lately and this really crystalizes why holding "no-password" assets alongside crypto makes sense - its not about picking sides but about surviving regime shifts. Really solid take on fat tail risk management.