The AI Loser Trap: Why Adobe Is a World-Class Business Trading at a Trough Multiple

The Real Story Behind Adobe’s Stock Collapse: How Market Sentiment Divorced Itself from Elite Cash Flows and a Weaponized AI Moat

This article is a free preview and tactical tip pulled directly from the November 21, 2025 edition of VMF's Security Selection. In that issue, we went deep on how we're positioning to profit from the biggest mispricings of the AI boom.

-

The market has a dangerous habit of painting with broad brushes.

Right now, the dominant narrative is simple and brutal: AI is eating software, and giants like Adobe are on the menu. This fear has driven Adobe’s stock down by more than 50% from its 2021 high.

It’s a perfect recipe for frustration, a world-class compounder stuck in a multi-year rut, with many investors sitting on meaningful unrealized losses.

But at VMF Research, we believe this collapse is a classic case of sentiment completely divorcing itself from fundamentals.

The market is pricing Adobe like a deeply impaired “Al loser.”

The numbers tell a story of a business running at full stride, generating elite cash flows, and weaponizing AI to secure its competitive moat. This disconnect is the definition of a generational opportunity in a quality franchise.

Anatomy of the Valuation Collapse

To understand the opportunity, you must first understand the panic. The market’s bearish view of Adobe rests on two pillars.

The first was the Figma acquisition saga.

Adobe announced a costly $20 billion cash-and-stock deal to buy the collaborative design platform in late 2022. Investors hated it immediately, seeing it as an admission of fear against a fast-growing rival.

The saga dragged through 2023, until the companies abandoned the deal in December 2023, citing insurmountable regulatory roadblocks from EU and UK antitrust authorities.

The core concern? The merger would eliminate competition and create too much dominance in key design markets.

Adobe ended up paying a $1 billion breakup fee. This left a double hangover: a 1$ billion bill and the lingering question of a strategic vulnerability.

The second, and more powerful, pillar is the “AI loser” label.

The fear is straightforward: why pay for Photoshop when you can just prompt an AI model for a “good enough” image in seconds? The free, open-source nature of many generative AI models has tempted investors to throw Adobe into the obsolescence bin.

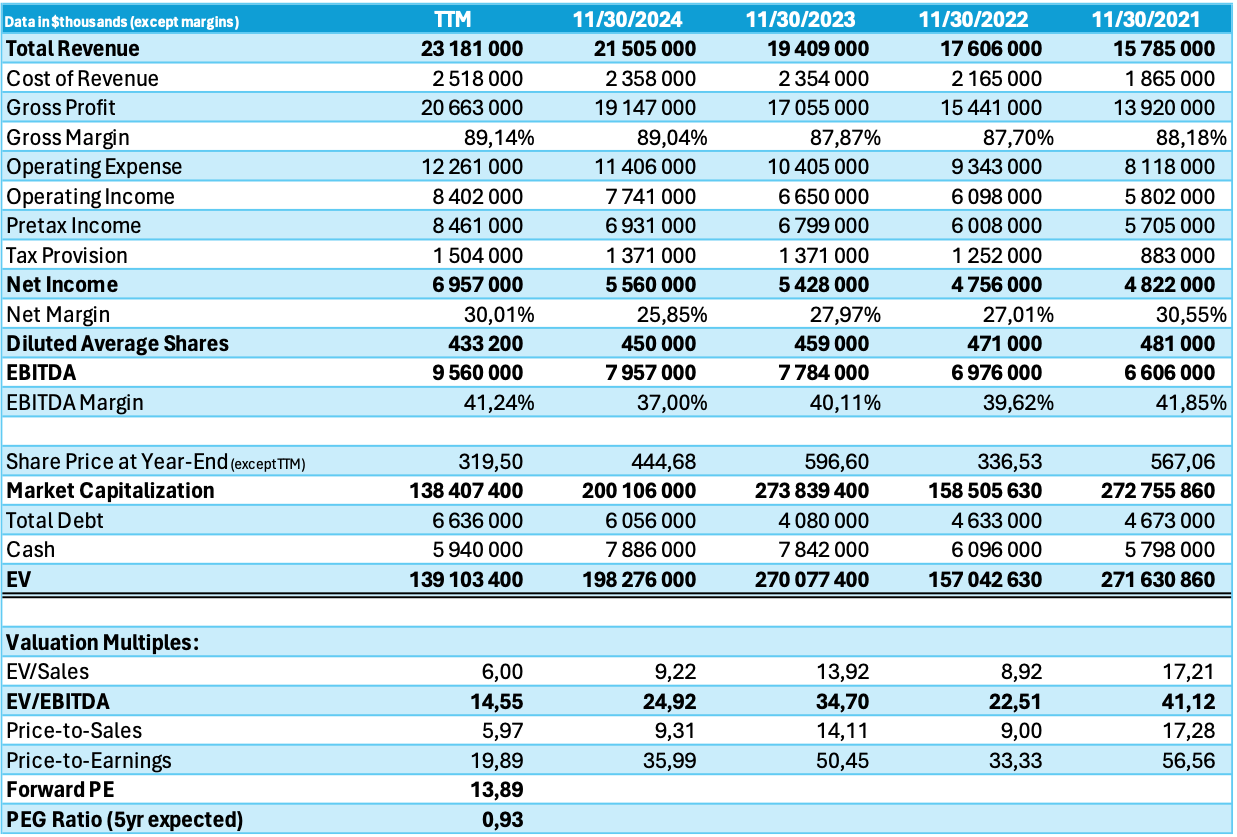

The result of these twin fears is a historic compression in valuation multiples:

The EV/EBITDA multiple, which peaked near 52x in 2021, fell to 34.7x in 2022 and is now trading around 14.55x.

The Price-to-Earnings ratio plummeted from a peak of over 56x in 2021 to below 20x.

Backward-looking multiples are now less than half, or even a third, of their 2021 peaks.

In short, the market is pricing Adobe as an average business facing existential decline.

But The Flywheel Is Running at Full Stride

The problem with the bearish narrative is that the flywheel hasn’t stumbled, let alone broken. The business continues to execute and grow, almost impervious to the noise.

Adobe’s core strength lies in its Creative Cloud and Digital Experience segments, which function as a powerful, integrated loop. This loop is what we call the compounding flywheel:

Create: Helping people make professional-grade content with tools like Photoshop and Illustrator.

Deliver & Measure: Helping businesses use that content to drive sales, manage campaigns, and measure results via the Experience Cloud.

This integration creates deep switching costs and workflow dependency.

And the financial evidence is undeniable:

Revenue and Earnings: Both the top line and bottom line continue to grow at a healthy clip. Total revenue exceeded $23 billion over the last 12 months, up 8% year-over-year

Elite Margins: Gross margins sit at an elite 89.14% and EBITDA margins are over 41%, remaining near pre-ChatGPT levels. This is evidence the business model has not been impaired.

Recurring Revenue: Over 95% of revenue is now subscription-based, giving the company predictable, high-quality cash flows. This is the result of the gutsy pivot in 2013, which turned the stock into a perennial compounder.

The only thing that has changed is not the performance of the business, but the cheap multiple the market is willing to pay for it.

Weaponizing AI to Secure the Moat

Adobe is not fighting AI, it is weaponizing it from within its established ecosystem. Its strategy is simple: turn the perceived threat into a competitive advantage for its high-value, professional customer base.

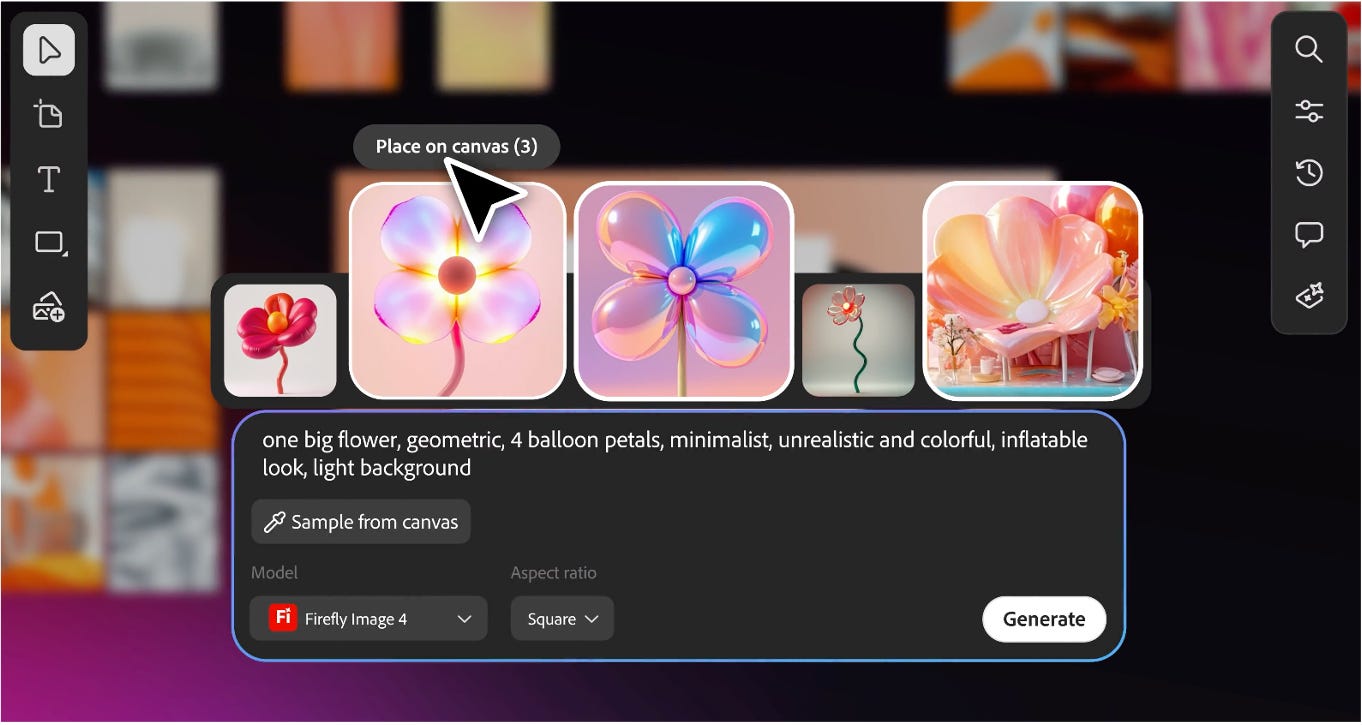

The key to this strategy is Adobe Firefly.

Firefly isn’t a standalone website; it’s a family of generative AI models wired directly into Photoshop, Illustrator, and other core Creative Cloud apps.

This integration cuts hours of tedious work from a professional’s week.

More importantly, Adobe is solving the biggest pain point for enterprise customers: commercial and legal risk.

Unlike many competitor models trained on scraped internet data, Firefly is trained primarily on Adobe Stock, licensed content, and public-domain material.

Adobe explicitly sells “commercially safe” AI, offering enterprise users IP indemnification for generated content on qualifying plans.

For a Fortune 500 company worried about copyright lawsuits, this is a decisive differentiator.

AI, in this context, is not a threat to Adobe’s cash machine. It is simply another highly profitable feature to:

Justify the existing subscription price.

Differentiate the platform and increase switching costs.

Charge more for heavier usage tiers.

Adobe is not an AI loser, it is setting itself up to be one of AI’s biggest cash winners.

The SemRush Play

It’s just the flywheel accelerating.

This move signals Adobe’s absolute refusal to tolerate competitive gaps, a pattern we’ve seen since Photoshop licensing and the Creative Cloud pivot. Semrush isn’t just an add-on; it’s a strategic preemptive strike.

While the market sees AI search eroding brand visibility, Adobe is buying the expertise. Generative Engine Optimization (GEO), that lets enterprises master this new discovery layer.

Adobe is taking control of the orchestration layer that governs whether a company brand is seen or not, effectively attacking the necessity of specialized agencies and platform middlemen at once.

This acquisition ensures that Adobe remains the indispensable center for content creation and distribution, locking in the next generation of enterprise spend.

Price Is What You Pay, Value Is What You Get

Warren Buffett was right: “Price is what you pay, value is what you get”.

Today, with the share price cut by more than half, Adobe is being priced like a below-average business with an impending structural challenge.

The truth is, this is a world-class compounding franchise. It possesses a decades-long history of successfully navigating platform shifts (from print to desktop to cloud), elite margins, and a dominant, integrated ecosystem. Even factoring in expected growth, Adobe’s PEG ratio of 0.93 suggests it’s a bargain.

As Michael Burry said, sometimes the process simply isn’t “in sync with the markets”. The market is chasing narrative; we’re backing numbers and history. That mismatch is the opportunity.

We are adding Adobe to our Quality Model Portfolio because you are rarely presented with a chance to own a market-dominating compounder at an emotionally distressed multiple.

This is a chance to buy extraordinary quality at a deeply discounted price.

Don’t let the noise of the “AI loser” narrative confuse you.

Don’t miss out on securing the institutional-grade research that identifies these asymmetric opportunities.

—

Join VMF Research today, to get access to our full Model Portfolios and exclusive research. Start transforming market narratives into conviction.

Disclaimer

The information provided herein is for general informational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any investment. It is not tailored to any specific individual or investor profile. All investments involve risks, and past performance is not indicative of future results. Before making any investment decisions, it is important to consider your own financial situation and risk tolerance. We do not guarantee the accuracy, completeness, or reliability of any information provided, and we disclaim any liability for any loss or damage arising from reliance on the information herein. Readers are advised to consult with an authorized financial intermediary before making any investment decisions.