The AI Capex Boom: Amazing for GDP, Dangerous for Investors (Ask 1929, 2000)

AI isn’t a tech story anymore. It’s a capital cycle.

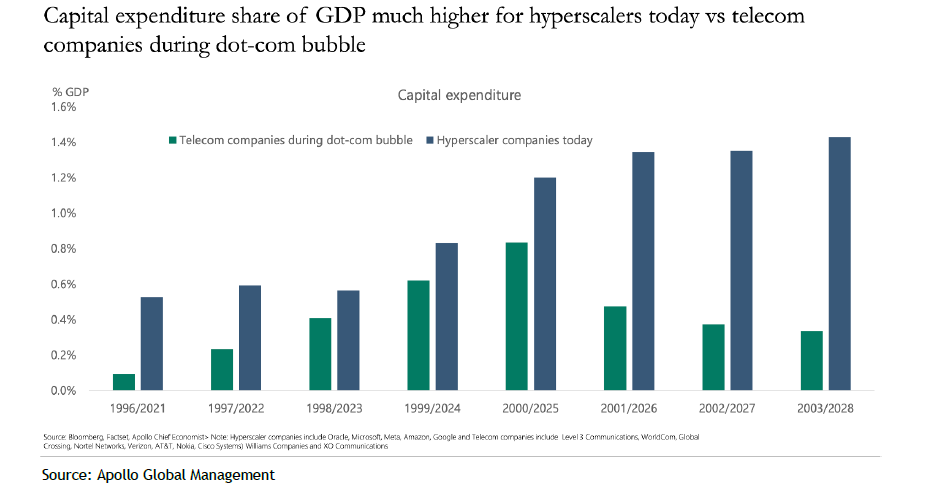

We’re on track for ~$400B of AI capex in 2025. The 2000 telecom peak was $113B… about $213B in today’s money. Meanwhile, consumer AI spend may at best reach ~$25B this year. The gap is enormous and requires a lot of heavy lifting to close, especially when you recognize that, unlike prior transformational buildouts, today’s GPU-heavy capex carries shorter useful lives and a faster depreciation clock. When gaps like this persist between capex and revenue, history says the capital cycle (not the narrative) wins the argument.

Here’s the thing: AI is not a niche anymore. It’s spilling into power, steel, concrete, wiring, GPUs, cooling, and fiber—with multiplier effects everywhere. Markets love it. GDP does too. But loving it, funding it, and earning a return on it are three very different things.

The Setup: Bigger, Faster, Loopier

We’re seeing circular deals that rhyme with late-1990s vendor-financing loops:

NVDA–OpenAI: plan to build at least 10 GW of AI data centers on NVIDIA systems, with up to $100B of NVIDIA investment tied to each GW deployed. The supplier helps finance the biggest buyer.

NVDA–CoreWeave: long-term agreement that backstops unsold GPU cloud capacity through 2032—manufactured “visibility” by another name.

NVDA–Lambda: NVIDIA leases back ~18,000 GPUs after selling chips into Lambda’s cloud (~$1.5B), essentially turning sales into services.

There are more, but we’re not here to single out names. None of this is illegal. It is circular and self-referential. Capital and contracts are helping manufacture demand optics while end-user monetization lags.

That amplifies the upside… and ultimately the reset.

What 2000 taught us (and why it matters now)

In the late 1990s, equipment vendors “lent to sell,” capacity swaps booked revenue without new customers, and round-trip deals juiced optics. When funding windows shut, receivables soured, take-or-pay got “renegotiated,” and stocks priced for perfection fell back to cash-flow gravity—Cisco down ~90% from the peak despite being a real business with real profits. The technology endured, but valuation excesses didn’t.

Sound familiar?

Replace fiber with GPUs and bandwidth with “compute,” and you’ve got the current script. The big difference is scale: today’s numbers are much larger, and the power/real-asset footprint is heavier. If AI revenue doesn’t catch up fast, the once-pristine balance sheets of the Magnificent Seven will drift toward capital-intensive utilities… without the benefit of regulated returns.

The 1920s electrification template: Loomis’s warning light

Electrification was the original operating-system upgrade for the economy.

It won.

But late in the 1920s, Alfred Lee Loomis watched generating capacity outpace realistic demand, prices detach from earnings, and leverage stack up in utility holding-company pyramids. He sold into strength before 1929 and kept his balance sheet clean. That decision saved him—and gave him dry powder for the 1930s.

Two lessons translate perfectly to AI today:

Capacity vs demand is the north star. When those lines diverge for too long, returns sag.

Balance-sheet discipline beats narratives. If your thesis depends on counterparties staying liquid and friendly, you don’t own cash flows—you own conditions.

The railroad echo: progress with painful cycles

The 19th-century railroad boom created the backbone of modern commerce… and a graveyard of busted promoters and overbuilt lines. The pattern was classic: cheap capital → land rush → overcapacity → restructurings → consolidation → durable winners.

That is the cadence of large buildouts. AI is rhyming already: massive fixed investment up front, demand curves that only reveal themselves later, and intermediate periods where utilization disappoints.

This Week’s Tape: Two Tells You Can’t Ignore

In our October Alpha Tier issue, we said transformational capex waves eventually pull in the state. Last week put that in neon:

Sam Altman effectively opened the door to U.S. government support—publicly discussing loan guarantees for chip plants and expanded CHIPS-style incentives. That’s the market admitting the private balance sheet alone may not close the capex–revenue gap fast enough.

Jensen Huang sparked headlines suggesting China could win the AI race… followed by clarifications. The point stands: AI leadership is geopolitical. When geopolitics sets the pace, policy sets the financing… and fragility in the system gets papered over, until it can’t.

Two separate signals.

One message:

This boom is long in the tooth and already leaning on policy. That validates our October thesis—and underscores why timing and risk controls matter now.

Bottom line:

AI will almost certainly deliver a decade of productivity. But investors don’t earn productivity… they earn returns, ultimately driven by cash flows bought at sensible prices. When capex outruns monetization, history says the capital cycle wins.

My stance:

Be curious about the tech, ruthless about the numbers, and allergic to circular growth. The winners will be obvious in hindsight. Our job is to protect capital now so we can buy those winners when expectations reset.

If you want the full analyst pack—charts, positioning, model-portfolio changes, and the signals we’re using—join VMF Research.

Here’s the first page of that issue you can find behind our paywall: