The 2026 Outliers

From Q-Day Shocks to the SpaceX Mania. How to Trade the Fat Tails

The future doesn't arrive politely. It kicks the door in.

In our December issue of Alpha Tier, we stepped outside Wall Street’s glossy investment outlooks and beyond their tidy ‘base-case’ forecasts.

Instead, we leaned into the Fat Tails, those extreme, low-probability events that have outsized, market-defining impacts.

As we start 2026, the question isn’t what is likely to happen, but what could happen that would make every conventional outlook obsolete?

By pressure-testing our worldview through both ‘Left Tail’ (crashes/panics) and ‘Right Tail’ (euphoric melt-ups) scenarios, we can build a portfolio resilient enough to survive a regime shift and convex enough to profit from it.

That’s why we went hunting through research notes for the boldest, most outlandish calls we could find.

Below is our take on the few that actually matter. We unpack them in far more depth behind the paywall.

Q-Day Manifesto

The first major “Outrageous Prediction” we must confront is Q-Day: the quantum breakthrough that meaningfully threatens modern encryption standards.

While it sounds like science fiction, the investment implications are grounded in a cold reality: The entire digital economy rests on the assumption that “the locks still work”.

This is most visible in the world of crypto.

A private key is only valuable because it is assumed to be impossible to counterfeit.

If a working quantum machine changes the calculus of what is considered “breakable,” the market won’t wait for peer-reviewed certainty; it will reprice trust instantly.

You might also like reading:

The “Swiftie Put”: Culture as a Macro Variable

Saxo Bank’s “Swiftie Put” scenario uses a cultural event, the Taylor Swift wedding, as a stylized shorthand for a deeper regime shift: a movement away from digital saturation and toward real-world formation.

We are tracking a growing fatigue with “algorithmic life”.

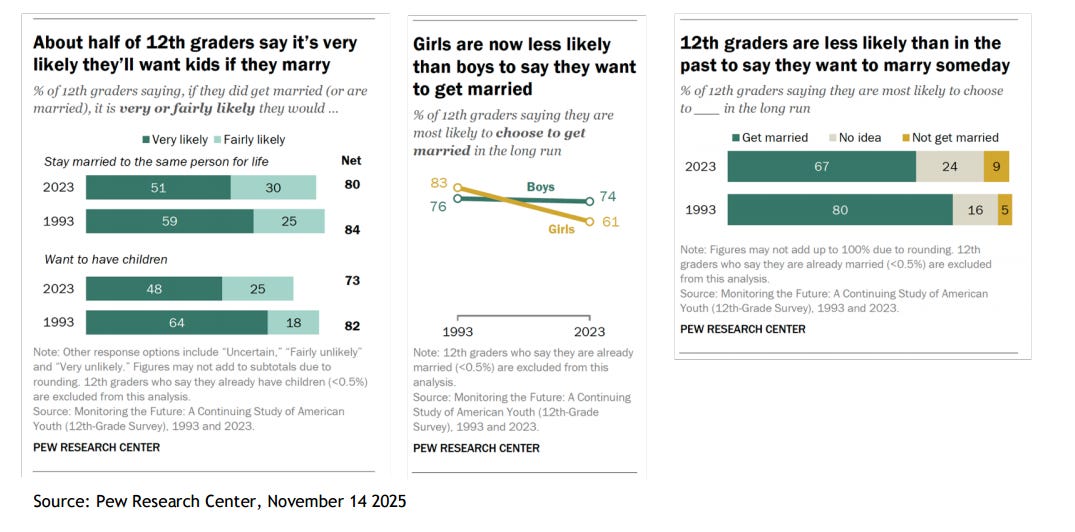

When 12th graders report lower confidence in traditional family formation and Gen Z begins favoring social media bans for minors, we are seeing the early “green shoots” of a new social mood.

It’s about Investment Payload: If attention begins migrating back to the physical world, it creates a powerful headwind for ad-driven social media empires that “sell time”.

Conversely, it tilts demand toward:

Real-world experiences: Travel, local services, and household formation.

Physical durables: Homebuilding and DIY over digital downloads.

GLP-1 Everywhere: The Right-Tail Consumer Shock

While many view obesity drugs as a “healthcare theme,” we see a transition from “specialist treatment” to “mainstream consumer utility”.

The recent FDA approval of Novo Nordisk’s once-daily oral Wegovy pill is a structural change that collapses the friction of injections and stigma.

Mapping the Chain Reaction:

Healthcare Winners: We are already positioned through Novo Nordisk, UnitedHealth, and Others.

Consumer Disruptors: A mass shift in caloric consumption changes the entire consumer basket. Food producers, restaurants, and snack categories are leaning the wrong way if this “appetite control” trend becomes routine.

To access our full 2026 Model Portfolio, including our specific allocations to what we see as an early-cycle upturn in healthcare, join our inner circle today.

The SpaceX IPO and the Robotics Feedback Loop

We view space as an emerging secular investment theme, one we’re beginning to express across our product suite.

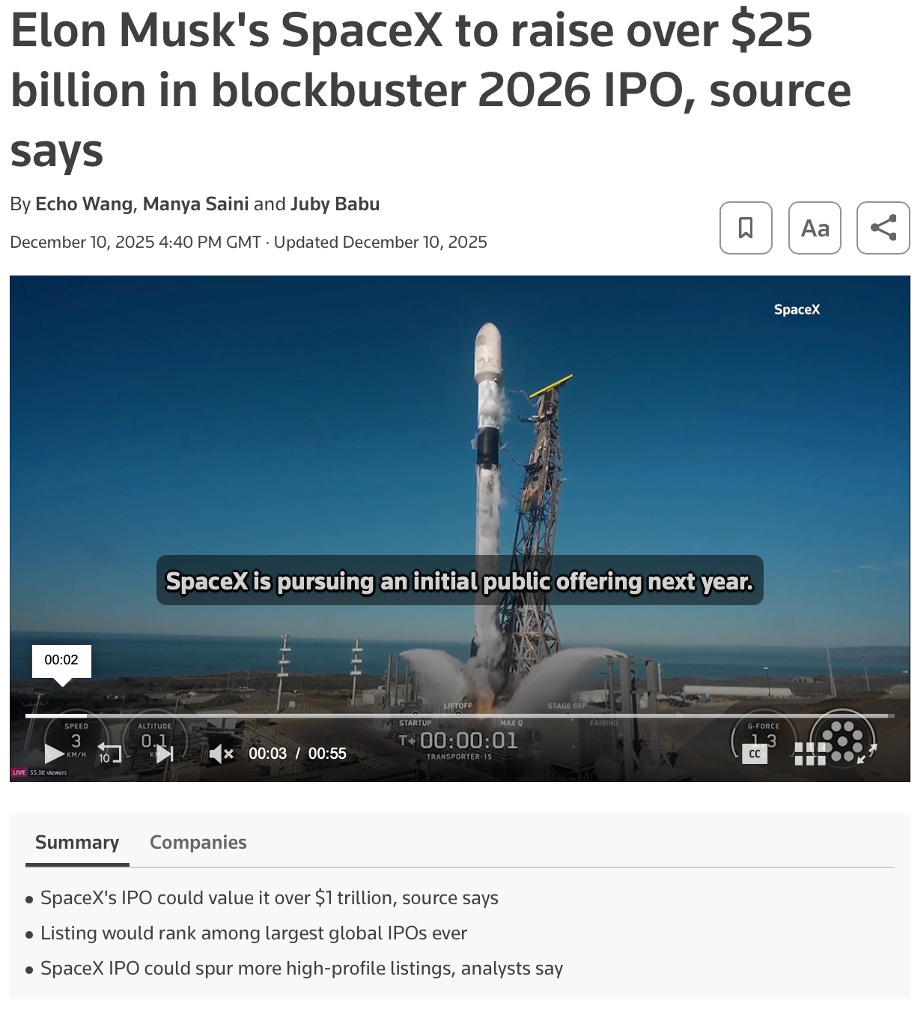

A key near-term catalyst is a potential SpaceX IPO as early as 2026. We don’t see that as "outrageous"... we see it as structurally inevitable.

Space exploration is the ultimate stress test for the themes we’ve explored all year: AI, robotics, and the capex supercycle.

Think of it as a Feedback Loop: AI enables robotics, robotics enables space, and space demands more AI.

When SpaceX goes public, it will turn space from a quasi-governmental endeavor into a commercial profit engine that can be modeled and packaged into ETFs.

We’re already expressing this frontier exposure through ARK Innovation (ARKK). For us, it’s the cleanest liquid way to play the moment software finally starts operating in the physical world, whether that’s in a warehouse or microgravity manufacturing.

And just like the railroads or the early internet, this is a genuine breakthrough that will eventually detach from reality and enter a full-blown mania phase.

We’re disciplined, but we’re ready.

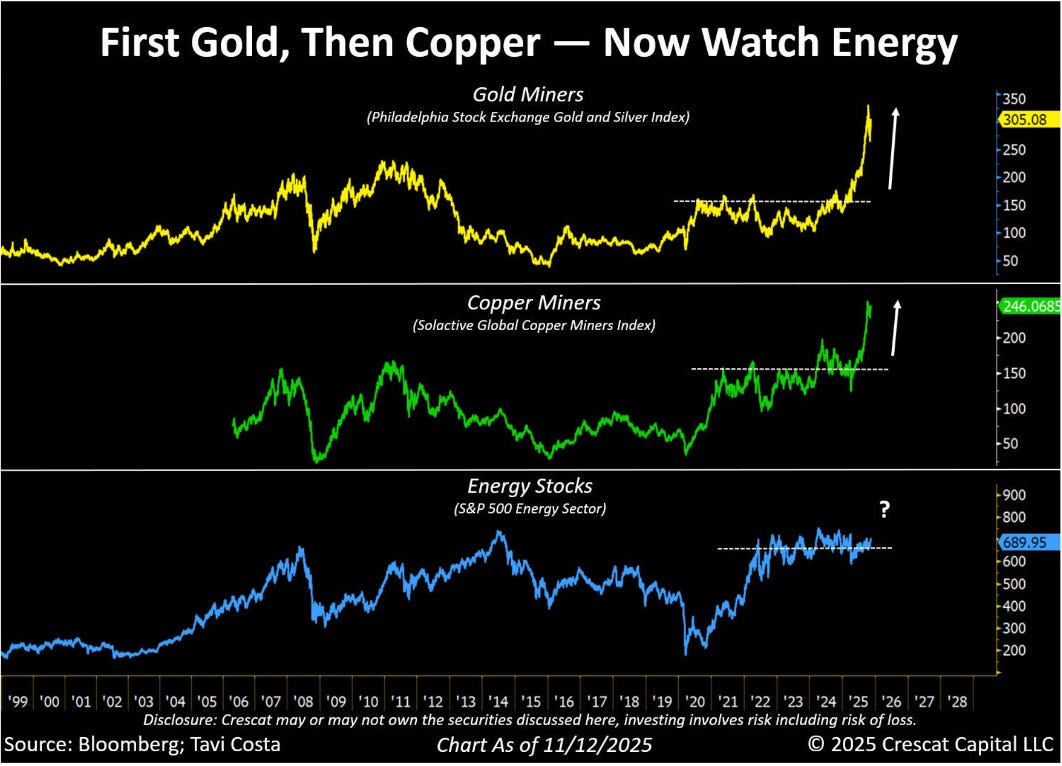

The “Swoon Before the Boom” in Energy

Finally, we must address our most contrarian stance: Energy.

While the consensus anticipates a “glut” that could drive oil into the $30s, we believe the supply side has been hollowed out by years of underinvestment.

We have been "early" on this trade, but we remain patient.

Our sector tilt via XLE and royalty play in Viper Energy (VNOM) are building a base that we expect to re-rate violently when the market realizes “peak demand” is a myth and supply cannot be turned on with a press release.

Surviving the Shift

The “normal” year is a myth; history is dominated by the tails.

Whether 2026 delivers a quantum shock or a space-fueled melt-up, the difference between spectators and winners will come down to positioning.

Our Model Portfolio is built for this volatility.

We own the Gold for the left tails, the Crypto and ARKK for the right tails, and the Energy and Healthcare for the structural regime shift.

The window to position for these 2026 shocks is closing… Get the full breakdown of our specific entry points, options overlay strategy, and the “Q-Day” cybersecurity deep-dive by joining Alpha Tier today.

Interesting take and focusing on fat tails instead of base cases is uncomfortable, but that’s usually where real opportunities live.

VMF, fat tails are the real game in 2026. Q-Day encryption breaks + SpaceX scale + nuclear baseload convergence = deliberate outliers. Throne steady. Looking forward to the full outlook. 🔥🇺🇸"