Reading the Room of a "Goldilocks" Consensus

They pretend to know, and the market pretends to believe.

So, every December, the big banks and asset managers roll out their glossy PDFs, heroically predicting the next twelve months.

They pretend to know, and the market pretends to believe.

We like to use this “Outlook Season” for something different: it is a rare window into the collective mind of the herd. Knowing where the consensus sit, and how firmly it thinks it sits there, is an incredibly valuable input for the Sentiment pillar of our process.

Here is what the room is saying as we enter 2026.

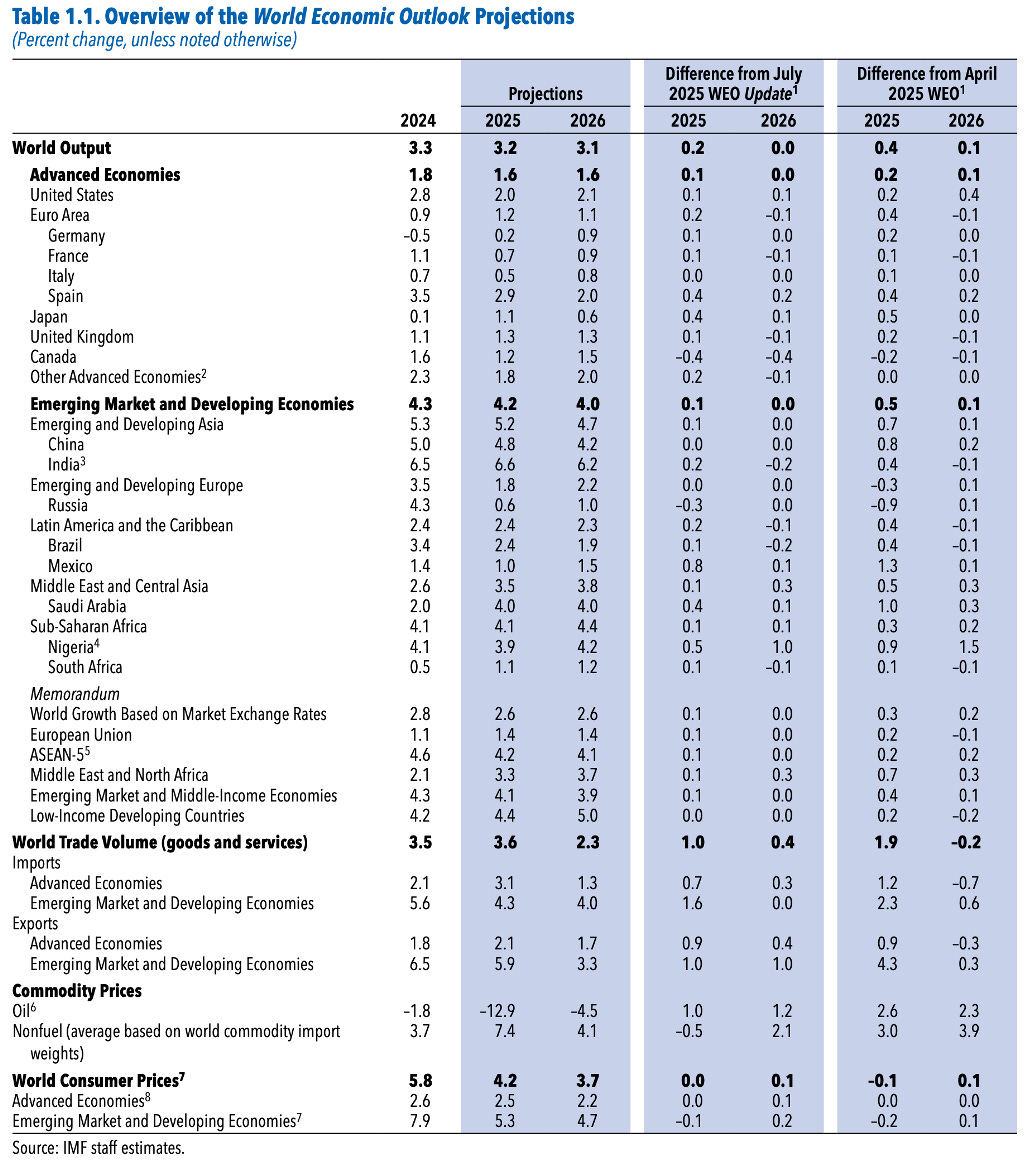

The IMF’s “Steady but Tired” Base Case

The backbone of almost every institutional deck is the IMF’s World Economic Outlook.

For 2026, the projection is a picture of an economy that continues to grow, but only just.

It describes a slow, slightly tired expansion where no one expects a boom, but no one is brave enough to call for a bust.

Global Output: Expected to rise by around 3.1% in 2026.

The Anchor: The United States remains the growth engine among advanced economies, with projected growth picking up to 2.1%.

The Laggard: Europe continues to trudge along with modest, almost lethargic expansion.

The Trend: World trade volume is expected to remain under pressure, growing at a lower rate than in past cycles. This is perfectly consistent with our view that onshoring and deglobalization are now structural features of the new market regime.

The AI Euphoria: Pushing the Limits of Physics

If you read the reports from Goldman Sachs or BlackRock, you’ll find a much louder story:

AI is no longer just a “theme”. It is the market’s center of gravity.

The consensus increasingly believes that AI-driven productivity can do what steam, electricity, and the digital revolution couldn’t: push U.S. growth above its long-term 2% trend.

BlackRock is even toying with a “benign singularity” scenario where AI generates, tests, and improves new concepts on its own, accelerating the very rate of discovery.

But look at the scale of the bet.

Voracious spending from the major U.S. cloud companies is fueling an investment boom that already dwarfs the internet capex of the late ‘90s as a share of GDP.

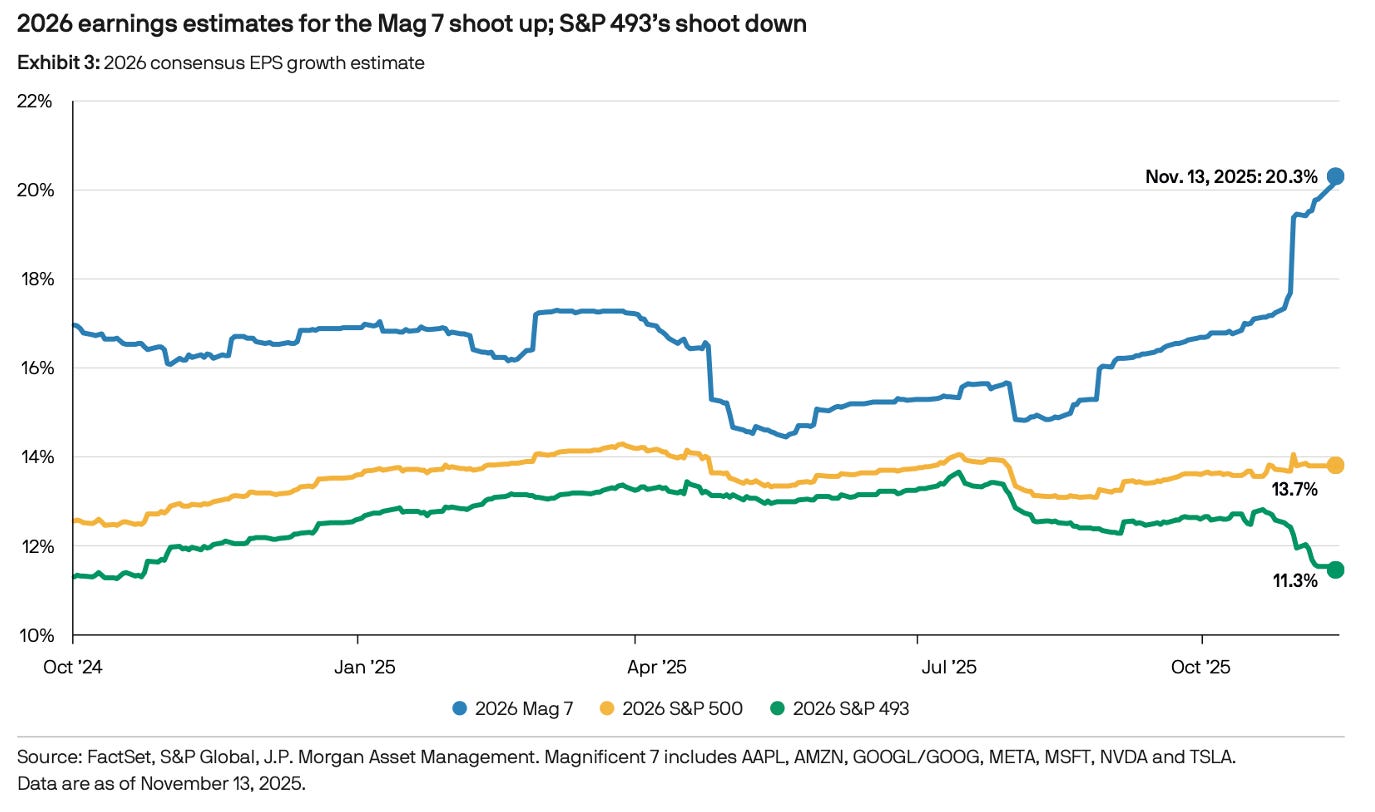

The “Magnificent Seven” are projected to grow earnings at a staggering 20.3%, while earnings estimates for the “S&P 493” (everything else in the index) are actually slipping toward 11.3%.

This concentration is a double-edged sword.

It justifies the price action for now, but it sets the bar uncomfortably high for management teams to keep exceeding these “pharaonic” expectations.

The “Fixed Income Is Back” (But Not Loved) Narrative

The 2026 Outlooks share another unifying theme: the traditional 60/40 portfolio is broken and “needs to be improved”.

Strategists claim fixed income is back because yields are finally respectable, but listen to the tone and you’ll notice they are back as a source of carry, not as a heroic hedge.

Major houses are now rotating toward TIPS (inflation-linked bonds) to hedge against the very inflationary regime we’ve been describing for months.

They are also piling into private credit, where banks are retreating and spreads remain fat, though they quietly warn about late-cycle risks and weaker covenants.

It is the “extra carry” bucket for those who still believe the soft-landing script will hold.

The Generational Guard-Change

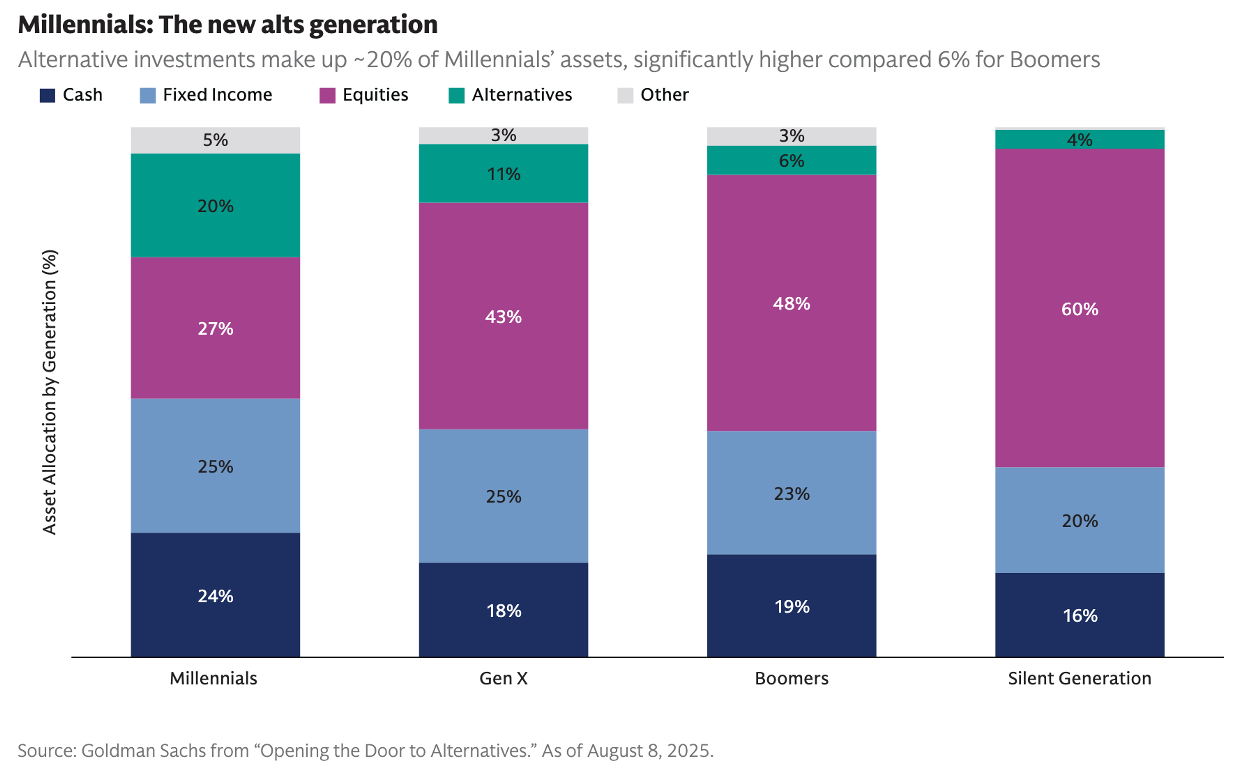

Perhaps the most revealing datapoint comes from the shift in asset allocation by generation.

Goldman Sachs’ data shows that Millennials and Gen Xers hold significantly higher allocations to Alternatives than the “Silent Generation” or Boomers.

Millennials: Roughly 20% allocation to Alts.

Boomers: Only about 6% allocation.

This isn’t just a trend; it’s a structural tailwind for real assets, precious metals, and crypto as peak earners move into the market and reject the traditional “stocks and bonds only” diet.

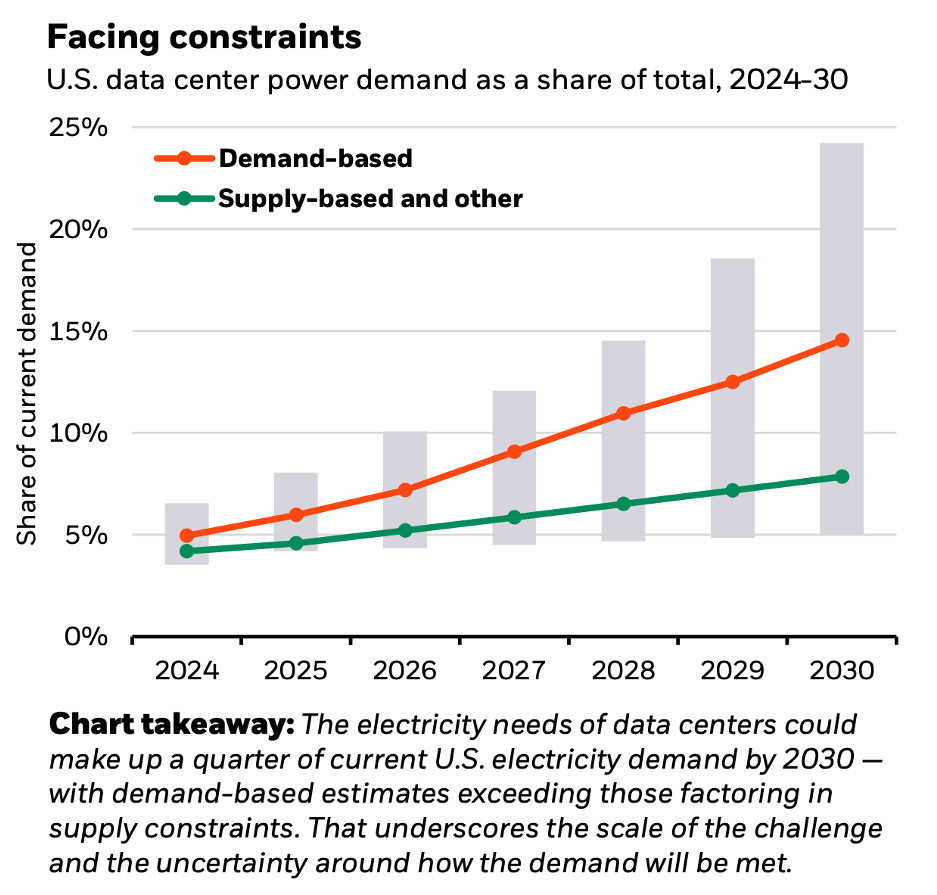

The Electricity Bottleneck

Where the consensus is finally catching up to us is in the “picks and shovels” of the AI build-out.

There is a growing realization that you cannot run the world’s most powerful computers on marketing slogans alone.

They need massive, reliable baseload power.

BlackRock’s data suggests that data center power demand could make up a quarter of current U.S. electricity demand by 2030.

This validates our ongoing commitment to uranium miners (URNM) and natural gas proxies like the Energy Select Sector SPDR Fund (XLE).

Electricity is rapidly emerging as the ultimate physical constraint of this digital boom.

The Reality Gap: Reading Between the Glossy Lines

Here is the problem: the consensus is currently positioned for a “Goldilocks” backdrop of moderate growth and fading inflation.

But look at the “lower branch” of the K-shaped economy.

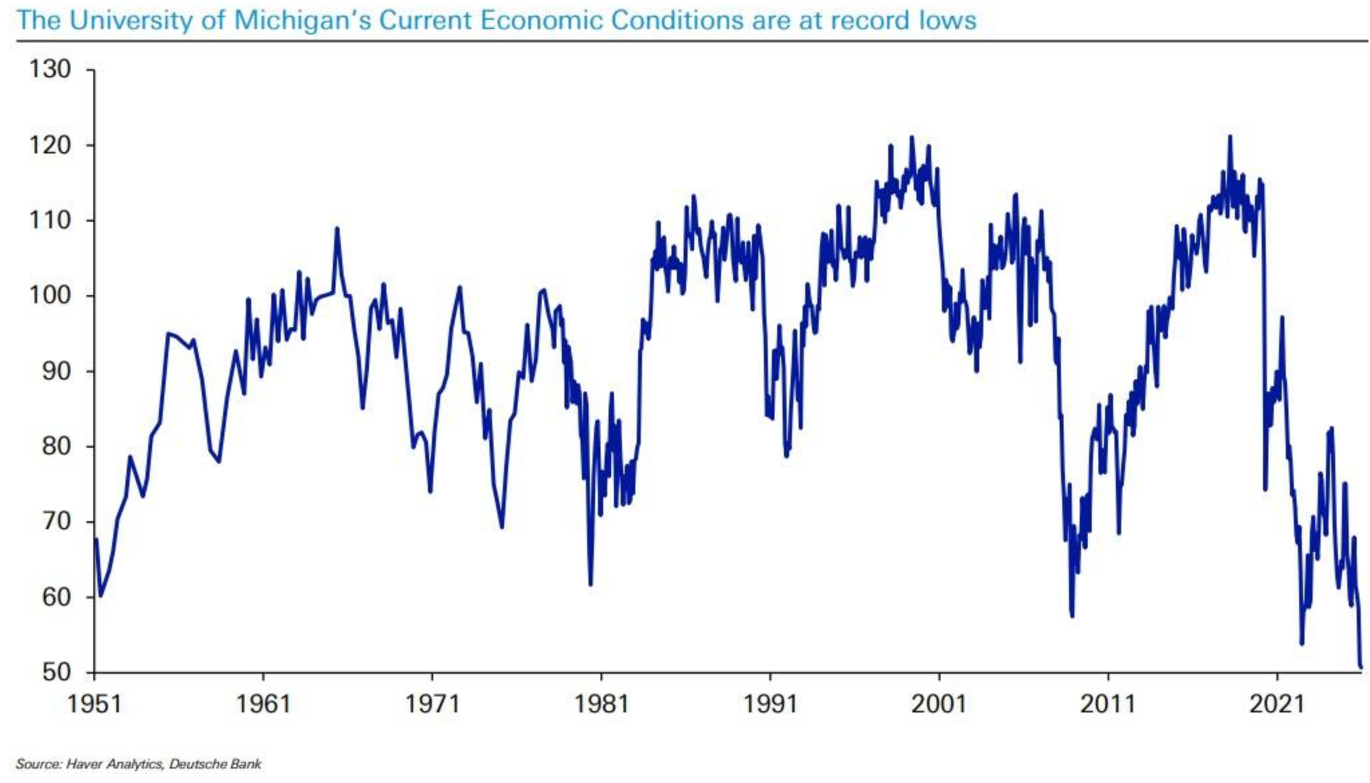

Household sentiment, as measured by the University of Michigan, sits at record lows even as stocks print record highs.

The “Upper K” is being levitated by record-breaking deficit spending at levels unseen in the U.S. outside of world wars.

We are watching a structural policy choice: keep the asset-owning class afloat with fiscal fuel and let the debt pile up.

As long as that continues, the room feels comfortable.

But credit markets are starting to whisper a different story.

We’ve seen credit default swaps (CDS) on companies like Oracle start to spike as investors question the debt used to fund these massive data centers.

The consensus is betting on a soft glide back to 2% inflation.

We think the tails are much fatter on both sides.

Would you like to see how we’re positioning our Model Portfolio to handle the resurgent inflation risk that the big bank Outlooks are completely ignoring?

Go Premium with a VMF Research Subscription.

What’s Next:

Our final part of our 2026 Outlook is out on the end of the week, and we will reveal our “Mathematical Charts” and why the Fed’s recent shift to technical bond buying is the ultimate “Turning Japanese” signal.