2025, The Year Process Beat Predictions

Talk is cheap, but allocations are not.

If there is one simple way to test whether an investment outlook is worth the paper it is printed on, it is to not start with the words, start with the actions.

Talk is cheap, but allocations are not.

As we close out the year, we want to look back at the positioning that defined 2025. At VMF Research, we do not treat January as a giant reset button. Instead, we focus on continuity and an evidence based process.

Here is what the first half of the decade’s most pivotal year taught us about staying disciplined when animal spirits run wild.

The Crash Helmet Strategy

Entering 2025, we recognized that the market was increasingly herding into the same “Goldilocks” narrative of a soft landing.

But we saw a front-loaded risk profile tied to new policy agendas and potential supply shocks.

Our answer was the Simplify US Equity Plus Downside Convexity ETF (SPD).

This gave us equity exposure with a “crash helmet”.

This move was validated almost immediately during the first quarter.

When the “Liberation Day” debacle hit and tariff fears rattled risk assets, SPD held up remarkably well, delivering genuine protection while others were caught overextended.

Finding AI Where It Was Cheap

The biggest theme of the year was undoubtedly the AI capex boom.

While the industry was obsessed with the Magnificent Seven at any price, we looked for a smarter entry point.

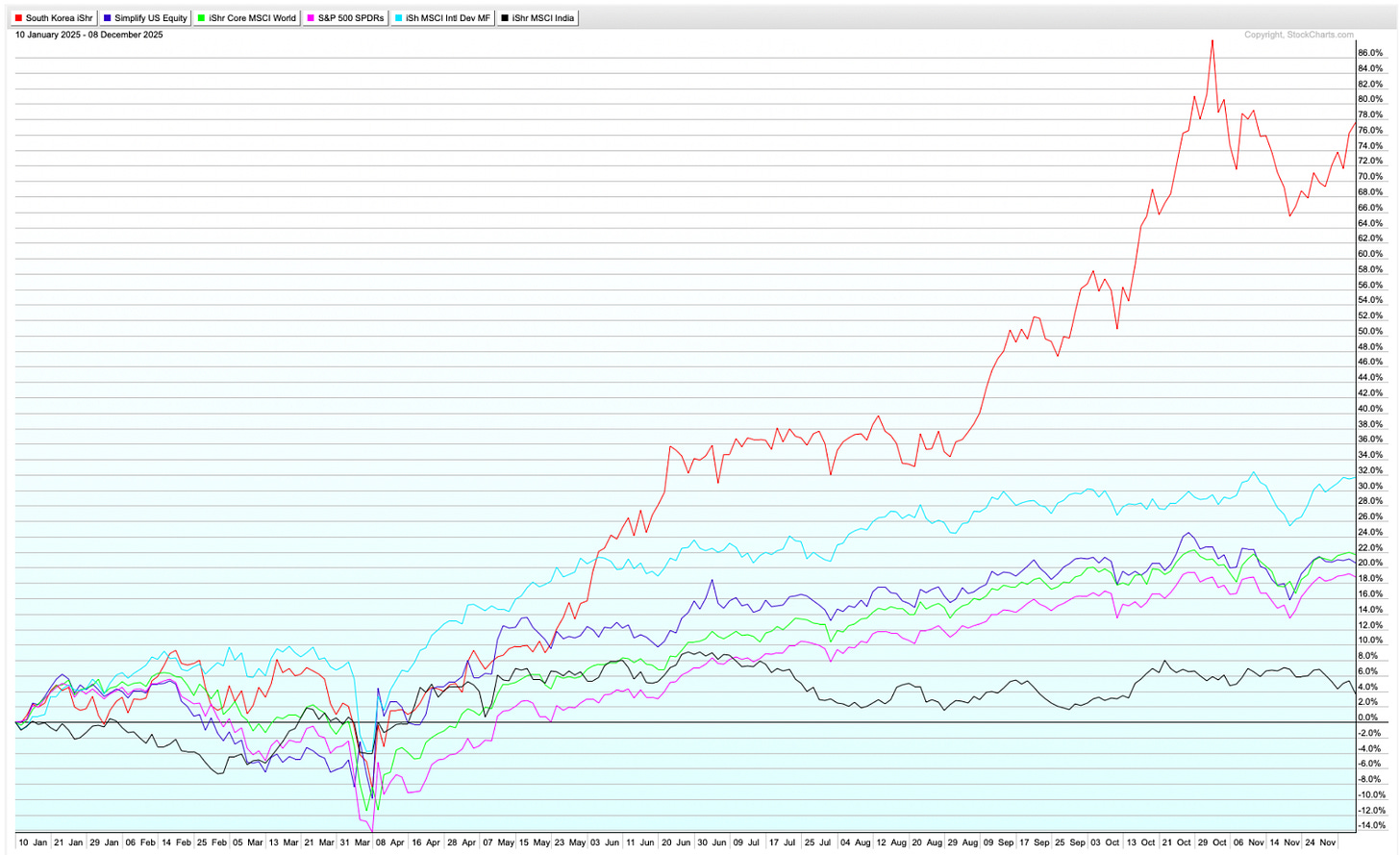

We added South Korean equities (EWY) as our chosen way to own the AI supply chain where it was still inexpensive and under-owned.

The result?

EWY did not just beat its benchmarks, it crushed them.

It outperformed developed and emerging market peers and even stacked up impressively against the US mega-caps.

By rotating out of expensive markets like India and into the South Korean “value trail,” we sidestepped high opportunity costs and captured one of the year’s biggest winners.

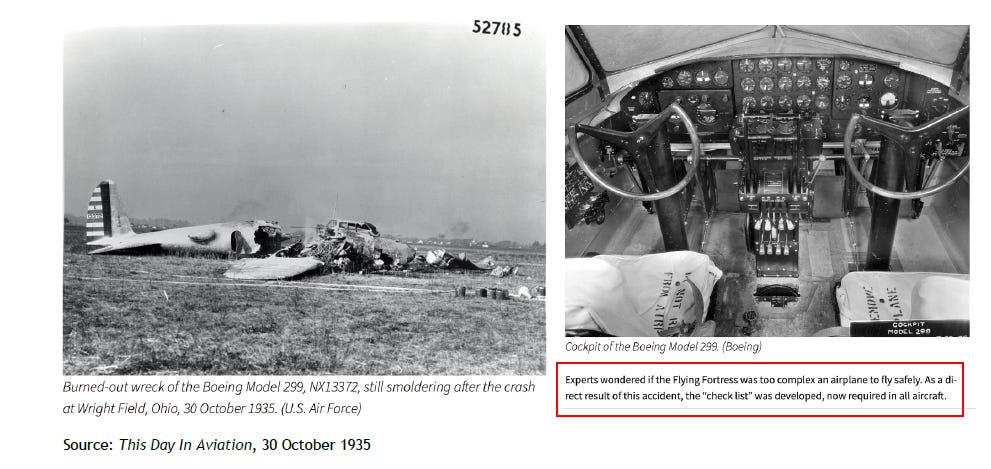

The Lessons of 1935

Why did this work? Because we try to prioritize process over ego.

We often cite the 1935 crash of Boeing’’ Model 299.

That plane did not fail because it was a bad design; it failed because it was too complex for one man to fly by memory alone. The solution was not a better pilot, but the invention of the checklist.

Financial markets are no different. In a melt-up, people confuse speed with safety. They start relying on “gut feel” and ignoring the math.

We stick to our Five Pillars: Fundamentals, Technicals, Sentiment, Macro, and Liquidity, to ensure we do not miss the obvious steps when the pressure peaks.

The Scoreboard

Looking back at our 2025 Outlook, the scoreboard validates this disciplined approach.

By the end of the year, we were using market strength to steadily trim risk.

Equities: Reduced from 60% to 52% as valuations hit historic extremes.

Fixed Income: Nudged down to 19%, as traditional bonds remain the primary casualty of our “Secular Inflation” regime.

Alternatives: Pushed up decisively to 29%. This is where the real winners of the current regime live.

The “debasement trade” we have been writing about since May 2024 is no longer a theory, it is in the returns.

Are you curious about how we are using this same process to identify the next big rotation in 2026?

Stay tuned.

Vasco.

Disclaimer

The information provided herein is for general informational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any investment. It is not tailored to any specific individual or investor profile. All investments involve risks, and past performance is not indicative of future results. Before making any investment decisions, it is important to consider your own financial situation and risk tolerance. We do not guarantee the accuracy, completeness, or reliability of any information provided, and we disclaim any liability for any loss or damage arising from reliance on the information herein. Readers are advised to consult with an authorized financial intermediary before making any investment decisions.